Participation in a composite return is elective. Note: For Tax Year 2017, the highest tax rate was 8.97%. For Tax Years 20, the North Carolina individual. Therefore, the composite return, Form NJ-1080C, uses the highest tax bracket of 10.75%. For Tax Years 2019, 2020, and 2021 the North Carolina individual income tax rate is 5.25 (0.0525).

Calculate your Missouri tax using the online tax calculator at or by using the worksheet in Section B below. A separate tax must be computed for you and your spouse. Since a composite return is a combination of various individuals, various rates cannot be assessed. Federal Income Tax Rates 22,000 - 89,450, 11,000 - 44,725, 15,700 - 59,850, 11,000 - 44,725 89,450 - 190,750, 44,725 - 95,375, 59,850 - 95,350. 2020 Tax Chart To identify your tax, use your Missouri taxable income from Form MO-1040, Line 26Y and 26S and the tax chart in Section A below. Marginal tax rate is the tax rate you pay on your last dollar of income in other words the highest rate you pay.

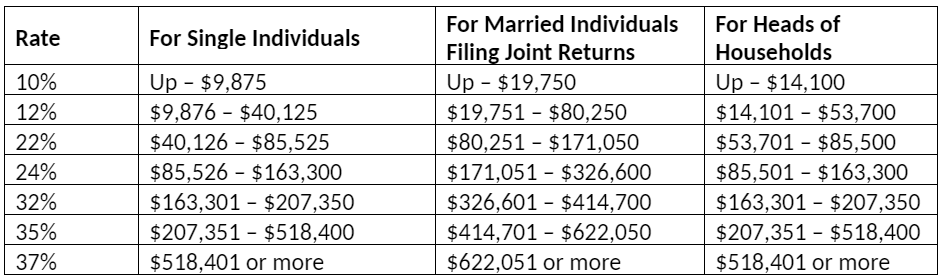

New Jersey has a graduated Income Tax rate, which means it imposes a higher tax rate the higher the income. If your taxable income for 2020 is 50,000 as a single filer, that puts you in the 22 tax bracket, because you earn more than 40,125 but less than 85,525. Technically, it is an individual return that each nonresident income earner must file, except that it is a composite filing of all the individual returns on one form. Tax Rate for Nonresident Composite Return (Form NJ-1080C)Ī composite return is a group filing. Estimate how much youll owe in federal taxes for tax year 2022, using your income, deductions and credits all in just a few steps with our tax calculator. Use the correct schedule for your filing status. You must use the New Jersey Tax Rate Schedules if your New Jersey taxable income is $100,000 or more. Tax Rate Schedules (2017 and Prior Returns) Tax Rate Schedules (2020 and After Returns) tax system is a progressive one, as income rises. When using the tax table, use the correct column. Taxpayers fall into one of seven brackets, depending on their taxable income: 10, 12, 22, 24, 32, 35 or 37. If your New Jersey taxable income is less than $100,000, you can use the New Jersey Tax Table or New Jersey Rate Schedules.

0 kommentar(er)

0 kommentar(er)